Unclaimed Assets Wisconsin: Discovering Hidden Treasures In Cheese Country

Imagine this—you’re sipping coffee on a lazy Saturday morning when you stumble upon an intriguing fact: Wisconsin has millions of dollars in unclaimed assets just waiting to be claimed. Yes, you read that right. Millions! So, why not take the opportunity to explore what could be yours?

Let’s face it, life gets busy, and sometimes we lose track of old bank accounts, insurance policies, or even forgotten stocks. But here's the good news—Wisconsin has a system in place to help people find and claim these lost treasures. The state government is actively working to reunite people with their unclaimed assets Wisconsin style.

Now, if you’re wondering how this whole process works, don’t worry. We’ve got your back. In this article, we’ll walk you through everything you need to know about unclaimed assets in Wisconsin. From the basics to advanced strategies, we’ll make sure you’re equipped to find what’s rightfully yours.

Read also:Can Facetime Be Downloaded On Android The Ultimate Guide Yoursquove Been Searching For

What Are Unclaimed Assets Wisconsin?

Before we dive deep, let’s break down what exactly we mean by "unclaimed assets." These are funds or properties that people have lost track of over the years. Think of it as a treasure hunt where the treasure is your own money! These assets can include old savings accounts, uncashed checks, insurance payouts, and even forgotten stocks.

In Wisconsin, the state holds onto these assets until their rightful owners come forward. It’s like a giant piggy bank where all the forgotten money is stored, just waiting for its owner to show up and claim it. And the best part? You don’t need a treasure map to find it—just a bit of determination and the right tools.

Why Should You Care About Unclaimed Assets?

Here’s the deal—unclaimed assets aren’t just for people who’ve misplaced a check or two. This could be a life-changing opportunity. Imagine finding out that you have thousands of dollars sitting in an old account you forgot about. That could help pay off debt, fund a vacation, or even give you the financial boost you’ve been needing.

Plus, it’s free money! Why leave something that belongs to you on the table? With the right knowledge, you can easily find and claim these assets. And who knows? You might discover a pleasant surprise that could change your financial situation for the better.

How to Find Unclaimed Assets Wisconsin

Alright, now that we’ve got your attention, let’s talk about the actual process of finding unclaimed assets in Wisconsin. It’s simpler than you think. The first step is to visit the official Wisconsin Department of Administration’s website. They’ve got a user-friendly database where you can search for your name or the names of your loved ones.

Here’s a quick guide to get you started:

Read also:Hood Rich Pablo Juan Release Date The Untold Story Behind The Hype

- Head over to the Wisconsin unclaimed property website.

- Type in your name, last known address, or any other relevant details.

- Review the results and see if anything pops up.

- If you find a match, follow the instructions to file a claim.

It’s as easy as that! And the best part? You can do it all from the comfort of your couch.

Using Online Tools to Locate Your Assets

While the Wisconsin Department of Administration’s website is a great starting point, there are other online tools you can use to broaden your search. Websites like MissingMoney.com and Unclaimed.org are excellent resources that can help you track down assets across multiple states.

Remember, unclaimed assets aren’t limited to just Wisconsin. If you’ve lived in other states or had financial ties elsewhere, it’s worth checking those databases too. You never know what you might find!

Understanding the Types of Unclaimed Assets

So, what exactly are we looking for when we talk about unclaimed assets? Let’s break it down:

- Bank Accounts: Forgotten savings or checking accounts that have been inactive for years.

- Uncashed Checks: Checks from employers, tax refunds, or other sources that were never cashed.

- Insurance Policies: Old life insurance policies that have matured but haven’t been claimed.

- Stocks and Bonds: Forgotten investments that could be worth a significant amount today.

- Safe Deposit Boxes: Contents of safe deposit boxes that were abandoned or forgotten.

Each of these assets has its own unique story, and finding them can be a rewarding experience. Whether it’s a small amount or a substantial sum, every bit counts when it comes to your financial well-being.

Steps to Claim Your Unclaimed Assets Wisconsin

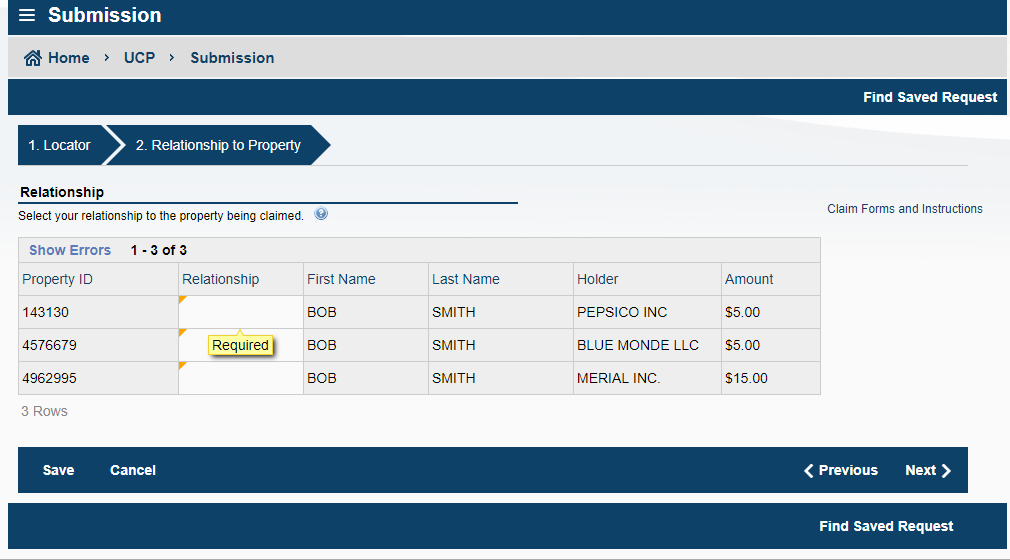

Once you’ve found potential matches for your unclaimed assets, it’s time to claim them. Here’s a step-by-step guide to help you through the process:

- Gather Documentation: You’ll need proof of identity, such as a driver’s license or passport. If the asset belongs to a deceased relative, you’ll need to provide a death certificate and proof of relationship.

- Fill Out the Claim Form: The website will provide you with a claim form. Fill it out completely and accurately to avoid delays.

- Submit Your Claim: Once your form is ready, submit it along with the required documentation. You can usually do this online or by mail.

- Wait for Processing: The processing time can vary, but most claims are resolved within a few weeks to a few months.

And just like that, you could be reunited with your lost money. Pretty cool, right?

Common Mistakes to Avoid When Claiming Unclaimed Assets

Now that you know the steps, let’s talk about some common mistakes people make when claiming unclaimed assets:

- Not Providing Enough Documentation: Make sure you have all the necessary papers before submitting your claim.

- Submitting Incomplete Forms: Double-check your forms to ensure everything is filled out correctly.

- Ignoring Deadlines: Some claims have expiration dates, so don’t miss the opportunity to claim your money.

Avoiding these pitfalls can save you a lot of time and frustration. Remember, the key is to stay organized and patient throughout the process.

Unclaimed Assets Wisconsin: The Legal Side

Before you dive headfirst into claiming your assets, it’s important to understand the legal aspects. In Wisconsin, as in most states, there are laws in place to protect both the state and the rightful owners of unclaimed assets. These laws ensure that the process is fair and transparent.

For instance, Wisconsin requires businesses and financial institutions to report and remit unclaimed assets to the state after a certain period of inactivity. This period is known as the dormancy period, and it varies depending on the type of asset. Once the state takes possession of the asset, it becomes the responsibility of the rightful owner to claim it.

How Long Do You Have to Claim Your Assets?

One common question people have is, “How long do I have to claim my unclaimed assets?” The good news is that in most cases, there’s no time limit. The state of Wisconsin will hold onto your assets indefinitely until you come forward to claim them. However, it’s always a good idea to act sooner rather than later, especially if you’re dealing with assets that could lose value over time.

Real-Life Success Stories: Unclaimed Assets Wisconsin

Let’s talk about some real-life success stories to inspire you. There are countless tales of people finding significant amounts of money through unclaimed assets. For instance, one Wisconsinite discovered over $50,000 in an old savings account they had forgotten about. Another found a life insurance policy worth $100,000 that had been sitting unclaimed for years.

These stories aren’t just fairy tales—they’re proof that unclaimed assets are a real opportunity for people to improve their financial situations. Who knows? You could be the next success story!

How to Prevent Losing Assets in the Future

Now that you’ve learned how to find and claim unclaimed assets, let’s talk about how to prevent losing them in the first place. Here are a few tips to keep your finances organized:

- Keep Track of Accounts: Make a list of all your bank accounts, insurance policies, and investments. Update it regularly to ensure nothing slips through the cracks.

- Set Up Automatic Alerts: Many financial institutions offer automatic alerts for account activity. This can help you stay on top of your finances.

- Communicate with Beneficiaries: If you have life insurance or other policies that name beneficiaries, make sure they know about them. This can prevent assets from going unclaimed after your passing.

By staying organized and proactive, you can avoid the headache of having to track down lost assets in the future.

Conclusion: Take Action Today!

So, there you have it—everything you need to know about unclaimed assets Wisconsin. From finding hidden treasures to preventing future losses, this guide has equipped you with the knowledge and tools to take control of your financial future.

Remember, unclaimed assets aren’t just a possibility—they’re a reality for many people. Don’t let your money sit idly by when it could be working for you. Take the time to search for and claim what’s rightfully yours.

And don’t forget to share this article with your friends and family. You never know who else might benefit from this information. Together, we can help each other find and claim the unclaimed assets that belong to us. So, what are you waiting for? Get started today!

Table of Contents

- What Are Unclaimed Assets Wisconsin?

- Why Should You Care About Unclaimed Assets?

- How to Find Unclaimed Assets Wisconsin

- Understanding the Types of Unclaimed Assets

- Steps to Claim Your Unclaimed Assets Wisconsin

- Unclaimed Assets Wisconsin: The Legal Side

- Real-Life Success Stories: Unclaimed Assets Wisconsin

- How to Prevent Losing Assets in the Future

- Conclusion: Take Action Today!

Article Recommendations